XRP is stuck in a tight range, and fresh on-chain data is adding a new twist to the story. Binance now holds about 2.5 billion XRP, the lowest level since early 2024. That is a big drop from around 3.2 billion XRP in November 2024. When XRP leaves exchanges, it often means fewer coins sit ready to sell at once. Traders often read this as lower short-term selling pressure and more long-term holding, especially when the XRP move looks steady instead of sudden.

This kind of setup has shown up in other major coins. Earlier this month, Ethereum exchange reserves fell to a multi-year low while price pulled back. The key point was behavior: coins moved off exchanges over time, which can point to storage and longer holding periods. XRP may be seeing a similar pattern. Binance XRP reserves have been trending down, and the pace picked up after Binance added XRP Ledger deposits for Ripple’s RLUSD stablecoin. The market expected RLUSD to bring more activity on-chain, and it did, but the first visible effect looks like XRP shifting off the exchange instead of piling up on it.

Price action, though, has stayed heavy. XRP traded near $1.47 at the time of writing after dropping about 6% in 24 hours. XRP also fell back below $1.50 after failing at $1.53. That failure matters because $1.50 is a round-number line that many technical traders watch. When XRP loses that level, some traders cut risk fast, and that can push XRP lower even if the bigger on-chain trend looks supportive.

The chart on the 30-minute Binance XRP/USDT view shows this tug-of-war clearly. XRP surged to a local peak near $1.66, then reversed in a sharp selloff. After the drop, XRP formed a flatter range around $1.47 to $1.50. The candles show smaller bodies after the big move, which often signals a pause while buyers and sellers reset. Volume tells the same story. The tallest volume bars appeared during the surge and the selloff, then volume cooled as XRP moved sideways. In the latest candles, XRP printed around $1.48 with about 1.34 million XRP in volume, which fits the idea of consolidation after a fast swing.

Momentum still leans bearish. The 14-day RSI was reported near 41.82, which is not oversold but sits on the weak side of the scale. That suggests XRP can still fall without needing a bounce based on “too cheap” conditions. In plain terms, XRP has not hit the kind of stretched level that forces shorts to cover.

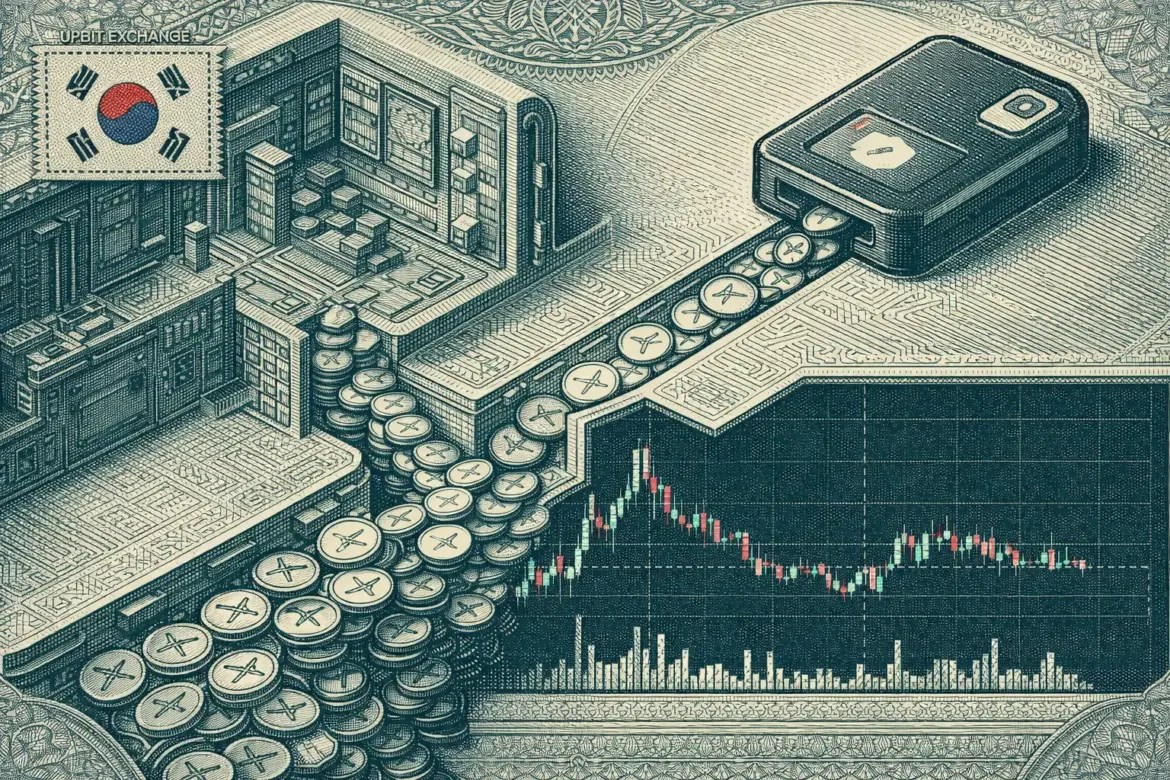

Another factor is where the selling came from. Reports pointed to heavy XRP selling on Upbit, with about 50 million XRP in net market sales over a short window. When one venue sees a rush to sell, it can drag the wider XRP price down because arbitrage links exchanges. That pressure can overpower slower signals like shrinking Binance XRP reserves, at least for a day or two.

Market value also moved fast. XRP’s market cap was reported to have dropped by more than $11 billion in about a day. Even in a soft market, that is a sharp swing. It lines up with the chart’s fast rejection from the highs and the heavy red candles that followed.

From here, traders are likely to focus on a few clear levels. On the upside, XRP faces resistance near $1.50 first, then around $1.53 where the rejection started. A stronger ceiling sits near $1.58 to $1.60, where the earlier run began to break down. On the downside, XRP has nearby support around $1.46, then $1.40 as the next major line. If XRP breaks and holds below $1.40, the chart would show a lower low, and that can invite more selling. If XRP holds $1.46 and reclaims $1.50, the chart would look more like a base, and traders may start watching for a push back toward $1.53.

The big question is timing. Falling Binance XRP reserves can reduce immediate sell supply, but XRP still needs demand to lift price. RLUSD on XRP Ledger may help over time by pulling more users and flows into the network. For now, XRP traders are watching whether coins moving into self-custody can offset the kind of fast, fear-based selling that shows up during exchange-driven dumps. XRP is giving both signals at once: quieter on-chain accumulation signs, and loud short-term selling waves. That mix often leads to choppy trading until one side wins.